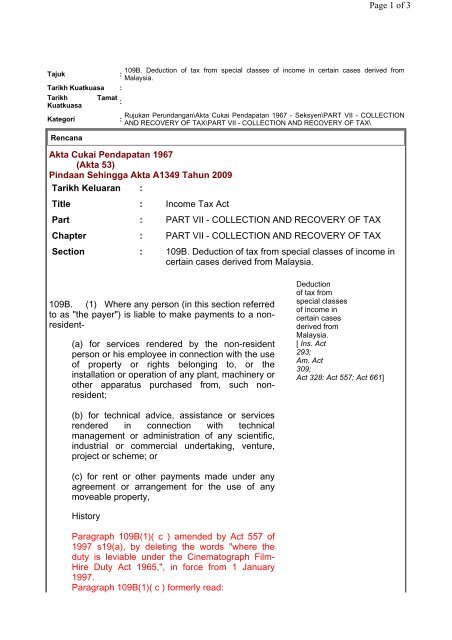

Income Tax Act 1967 Revised 1971 LAWS OF MALAYSIA. Income Tax Act 1967- Part 7 in Statute.

December 2018 Legally Malaysians

And b thereafter where the members funds of such co-operative society as at the first day of the basis period for the year of assessment is less than seven hundred and fifty thousand ringgit.

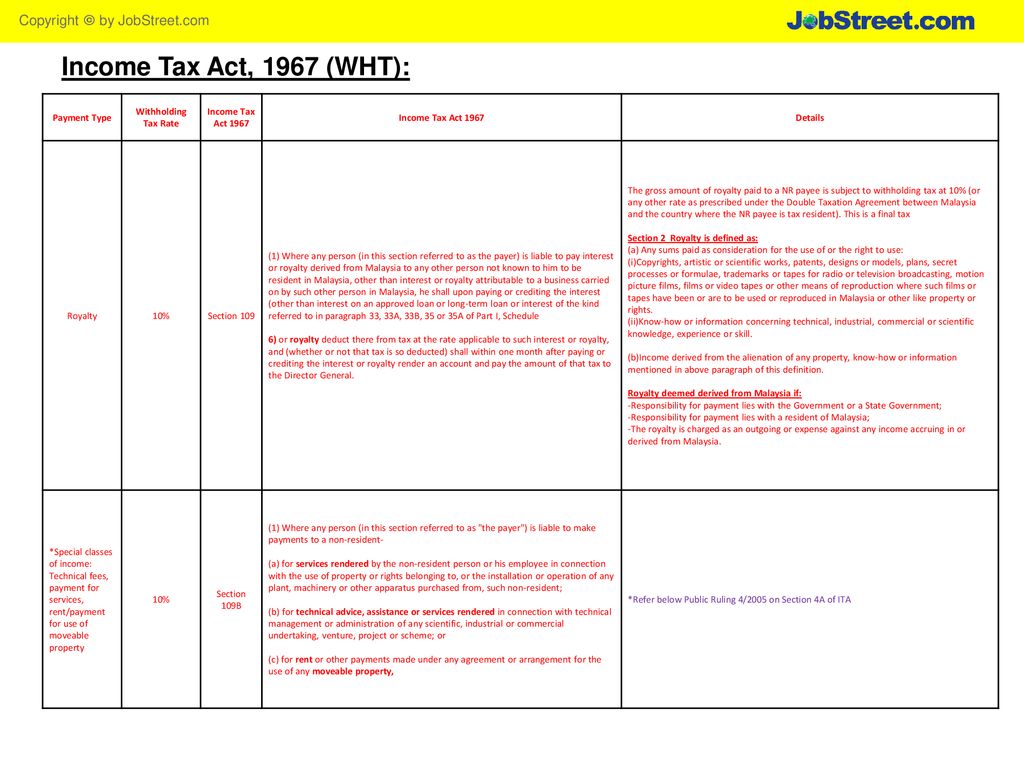

. Maximum amount of interest Section 140C of the Income Tax Act 1967 and the Income Tax Restriction on Deductibility of Interest Rules 2019. It looks like youre offline. An Act to impose a tax upon income from the winning of petroleum in Malaysia to provide for the assessment and collection thereof and for purposes connected therewith.

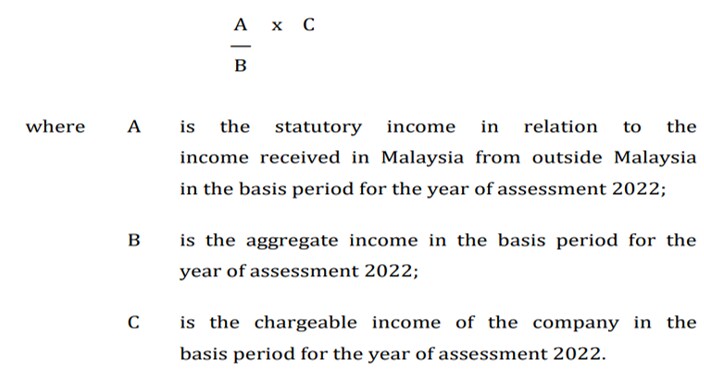

Income tax rules and legislative notifications have been reproduced or summarised in an easy-to-read table format. In doing so the taxpayer has a choice to either. Is exempted from tax by virtue of Schedule 6 Paragraph 28 of ITA 1967-Income from outside Malaysia but not received in Malaysia is not chargeable to tax as it is not within the scope of Section 3 of ITA 1967.

28 September 1967 BE IT ENACTED by the Seri Paduka Baginda Yang di-Pertuan Agong with the advice and consent of the Dewan Negara and Dewan Rakyat in Parliament assembled and. Unannotated Statutes of Malaysia - Principal ActsINCOME TAX ACT 1967 Act 53INCOME TAX ACT 1967 ACT 5383Return by employer 83. Return by employer 1 Every employer shall for each year furnish to the Director General a return in the prescribed form not later than 31 March in the year immediately following the first-mentioned year containing--.

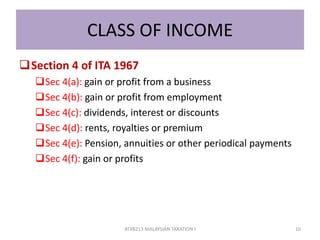

A preferential tax rate of 3 will apply to the Labuan entity on its net profits from Labuan business activities if it meets the substantial activity requirements otherwise it will be subject to a tax rate of 24 on its net profits. This page is currently under maintenance. BASIS AND SCOPE OF MALAYSIAN TAXATION Question 1 List any four chargeable person s under the Income Tax Act 1967.

Pursuant to section 2 of the ITA 1967 most business entities are generally taxable given the wide definition of a taxable person. Get Assignment HelpIncome Tax Act 1967 stated about a foreign worker or person entitled to have tax resident status in Malaysia under section 7. New section 6D effective from YA 2021 of the Malaysia Income Tax Act 1967 as amended ITA-Budget 2020.

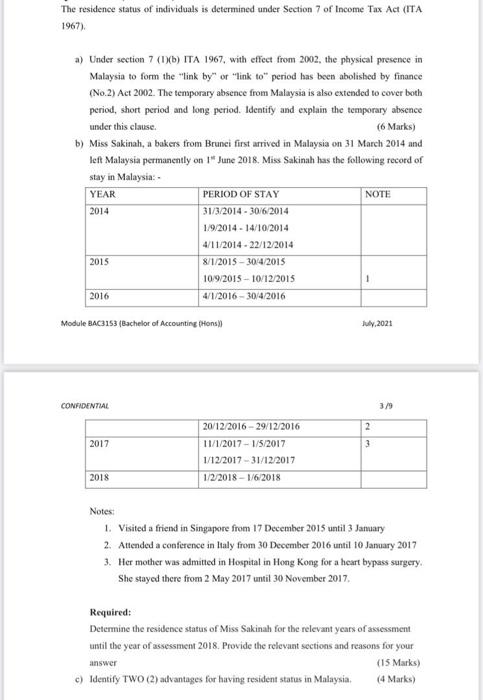

Income Tax Act 1967 by Malaysia 1971 Di-chetak oleh Penchetak Kerajaan edition in English. Tax Appeal and Judicial Review Processes Against Tax Authorities in Malaysia Introduction Under the Income Tax Act 1967 ITA 1967 a potential taxpayer must file a tax return to the Inland Revenue Board IRB disclosing financial details for the year causing any possible tax liability. 1 For the purposes of this Act an individual is resident in Malaysia for the basis year for a particular year of assessment if a he is in Malaysia in that basis year for a period or periods amounting in all to one hundred and eighty-two days or more.

F a person who has been granted an exemption under Sections 1273b or 1273A of the ITA in respect of the adjusted income of the person. Tax rebates for newly commenced business of a company or limited liability partnership only The ITA 1967 has introduced a new section 6D into Act 53 to provide for a tax rebate that will be. Schedule 4A of the Income Tax Act 1967 allows a person carrying on an approved agricultural project to elect so that the qualifying capital expenditure incurred by him in respect of that project is deducted from his aggregate income including income from other sources.

AUTHORITY OF THE REVISION OF LAWS ACT 1968 IN COLLABORATION WITH MALAYAN LAW JOURNAL SDN BHD AND PERCETAKAN NASIONAL MALAYSIA BHD 2006 Act 53 INCOME TAX ACT 1967 Incorporating all amendments up to 1 January 2006 053e FM Page 1 Thursday April 6 2006 1207 PM. A business entity in Malaysia is subject to the Income Tax Act 1967 ITA 1967 to pay taxes for any income generated through its operations. Malaysia Income Tax Act 1967 with Complete Regulations and Rules is appropriate for practitioners to use in court practical as a desk or portable reference and reliable as a student text.

Income tax act 1967. Or Income Tax Act 1967. 7 ITA 1967 - Residence Individuals Residence.

Federal Legislation Portal Malaysia. The chargeability of income is governed by Section 3 of the Income Tax Act 1967 ITA which states that income shall be charged for tax for each year of assessment YA upon the income of any person accruing in or derived from Malaysia or received in. Laws of malaysia reprint published by the commissioner of law revision malaysia under the authority of the revision of laws act 1968 in collaboration with malayan law journal sdn bhd and percetakan nasional malaysia bhd 2006 act 53 income tax act 1967 incorporating all amendments up to 1 january 2006 053e fm page 1 thursday april 6 2006 12.

Reference to the updated Income Tax Act 1967 which incorporates the latest amendments last updated 1 March 2021 made by Finance Act 2017 Act 785 can be accessed through the Attorney Generals Chamber Official Portal at the following link. Several clauses highlight the requirement for a. 2 days agoTan Sri Shahrir Samad 72 was charged with money laundering by not reporting the real income in the income tax form which is a violation of Section 1131a of the Income Tax Act 1967 which is not declaring the income amounting to RM1 million received from Najib through a cheque which was later banked into the account of the accused.

Finance Law Share this article a any deductions made under section 34 pursuant to this Schedule in respect of that expenditure from the gross income of the operator from the relevant business for the basis period for any year of assessment being a basis period ending before that date. 1 The income of any co-operative society- a in respect of a period of five years commencing from the date of registration of such co-operative society.

Solved The Residence Status Of Individuals Is Determined Chegg Com

Laws Of Malaysia Income Tax Regulations

Micci Malaysian International Chambers Of Commerce Industry

Malaysia Income Tax Act 1967 With Complete Regulations And Rules 9th Edition Taxation New Releases

How Much Does It Cost To Develop A Law Firm Mobile App Development

Wolters Kluwer Malaysia Cch Books Malaysia Income Tax Act 9th Ed

Guidelines On The Application Of Subsections 12 3 And 12 4 Of The Income Tax Act 1967 In Determining A Place Of Business Amcham

Mwka Online Talk Am I A Tax Resident In Malaysia

Malaysia Personal Income Tax Guide 2021 Ya 2020

Pr Po Process Flow By Jace Cheah Ppt Download

Solved Taxation In Malaysia 2020 1 Although The Income Tax Chegg Com

Broadening The Tax Net Under Section 12 Crowe Malaysia Plt

109b Deduction Of Tax From Special Classes Of Income In Certain

Mia Webinar Series Managing Income Tax Audit Challenges Effectively A Practical Approach With Case Studies During The Current Challenging And Complex Domestic And Global Tax Environment How Can You Better Manage

Best Payroll And Tax Services In Switzerland